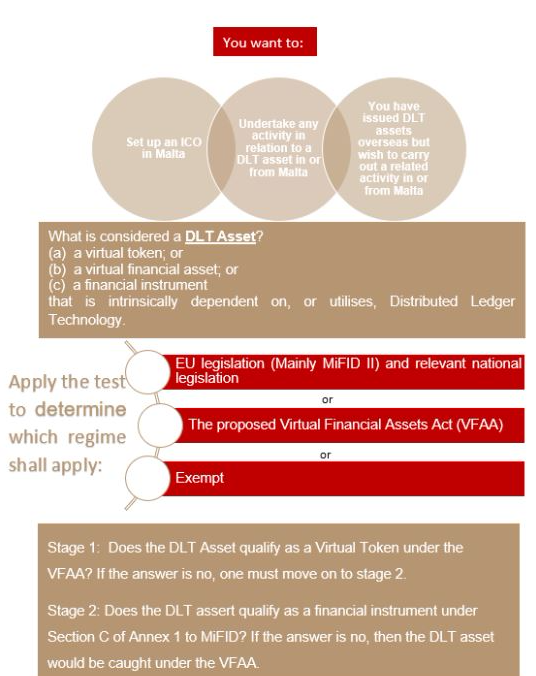

The MFSA has recently issued a Financial Instruments Test ('the Test') which those setting up an ICO in Malta or undertaking any activity in relation to such DLT assets in or from Malta, including those already issued overseas will need to apply to determine which set of regulations will regulate their business. The Test will determine whether a DLT asset will be treated as a Virtual Token, a Virtual Financial Token or as a financial instrument under MiFID.

The Malta Financial Services Authority (‘MFSA’) shed some light on the framework of the Financial Instruments Test (the ‘Test’) which it had proposed in an earlier Discussion Paper on Initial Coin Offerings (‘ICOs’), Virtual Currencies and Related Service Providers which was issued on 30th November 2017. This was done through a new Consultation Paper on the Financial Instruments Test (the ‘Consultation Paper’) whereby the MFSA is inviting all interested parties to submit their feedback until 4th May 2018.

The Consultation Paper builds upon prior feedback received from industry specialists in Malta who welcomed the introduction of the Test as a means to provide certainty and peace of mind as to adequate consumer protection and clarifies the objectives of the proposed Test and how it shall operate.

What is the object of the Financial Instruments Test?

The MFSA’s Consultation Document proposed the introduction of the Test as a mandatory requirement under the Virtual Financial Assets Act (the ‘VFAA’, previously known as the Virtual Currencies Act)

The objective of the Test is to determine how a Distributed Ledger Technology (‘DLT’) asset should be classified. It is being proposed that the Test will consist of two stages:

Stage 1: Does the DLT Asset qualify as a Virtual Token under the VFAA? If the answer is no, one must move on to stage 2.

Stage 2: Does the DLT asset qualify as a financial instrument under Section C of Annex 1 to MiFID? If the answer is no, then the DLT asset would be caught under the VFAA.

Who needs to carry out the test?

The Test shall be applicable to issuers of ICOs conducted in or from within Malta in order to determine whether the respective activity should fall within the context of the applicable EU and respective national legislative and regulatory frameworks or otherwise.

Additionally, entities who intend to provide a service or perform any activity in relation to DLT assets whose classification has not been determined for any reason, including where the issuing of such assets was conducted abroad, need to conduct the Test before carrying out any related activities.

Get More Info!

Our Fintech Practice

The Financial Services Specialists at Chetcuti Cauchi Advocates are in the process of providing their feedback with respect to the Consultation Document. They have been involved and have provided their feedback to Government agencies since Malta announced its goal to become a Blockchain Island since the last quarter of 2017.

Our lawyers and financial services specialists at Chetcuti Cauchi Advocates provide bespoke solutions to clients by combining the traditional legal fabric with new technologies. Our Fintech practice strives to assist clients in this burgeoning and evolving sector of law, which is set to reshape the financial services sector as we know it.

If you would like more information as to how the Financial Instruments Test may impact your business once you set up in Malta, or are interested in the setting up of a DLT company or a cryptocurrency exchange, or alternatively would like to set up a Crypto Fund in Malta, we welcome you to get in touch with our specialists.